Reprieve for Kenyans as Treasury Announces Plan for Tax Cuts

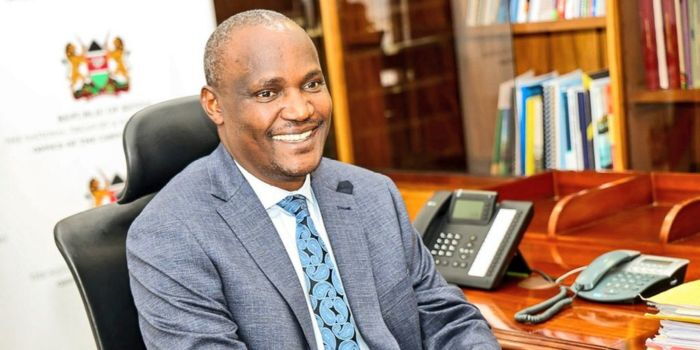

Treasury Cabinet Secretary John Mbadi has revealed the government’s plan to reduce taxes over the next three years, in a bid to ease the financial burden on Kenyans.

Speaking at the launch of the Financial Year 2025/26 Budget Preparation Process on Monday, Mbadi announced that the Value Added Tax (VAT) will be reduced from 16% to 14% while corporate tax will drop from 30% to 25%.

The move is part of a broader strategy to foster economic resilience, particularly in key sectors such as agriculture, manufacturing, and housing.

Mbadi emphasised that while the government will not support any additional expenditures in the medium term, it will instead focus on improving efficiency, accountability, and the prudent use of resources.

“The government is committed to fiscal discipline. We aim to enhance transparency in our financial management systems and in procurement processes,” Mbadi stated.

“Despite the fiscal constraints we are facing, we will ensure growth, expand opportunities, and prioritize sectors critical for economic recovery.”

Agriculture, he added, would remain at the heart of the government’s strategy to drive manufacturing and economic growth, with a specific focus on supporting small and medium enterprises (SMEs) and affordable housing projects.