Govt Removes VAT On Bread & 9 Others After Uproar From Kenyans

The Kenya Kwanza Parliamentary Group has confirmed the removal of several punitive tax proposals in the Finance Bill 2024, during a press briefing held on Tuesday, June 18 at State House.

Speaking after the Group’s session, Finance Committee Chair Kimani Kuria announced that the government was able to respond to the feedback of Kenyans through the reduction of taxes.

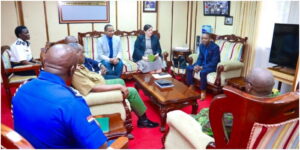

President William Ruto speaking during a Kenya Kwanza Parliamentary Group meeting at State House, Nairobi on June 18, 2024. /PCS

Top of the list to be struck off is the plan to impose a 16 per cent Value Added Tax (VAT) on bread, financial services and foreign exchange transactions.

“We are all in agreement that there are two things we must do. One of them is to protect Kenyans from increased cost of living and therefore the proposed 16 percent VAT on bread has been dropped,” Kuria stated.

“To support again on reducing the cost of living, we’re doing something about vegetable oil so that we do not make it expensive for Kenyans.”

On the Social Health Insurance Fund (SHIF) and Housing Levy statutory deductions, the MP noted that the deductions would be allowable to Pay As You Earn (PAYE), thus saving salaried Kenyans from paying an additional PAYE on them.

“Levies on the Housing Fund and Social Health Insurance will become income tax deductible. This means the levies will not attract income tax, putting much more money in the pockets of employees,” he remarked.

Regarding the Eco Levy, Kuria clarified that it would only apply to imported finished products, thus sparing those manufactured within Kenya. He further specified that diapers and sanitary towels produced domestically would not be subject to this levy.

“Consequently, locally manufactured products, including sanitary towels, diapers, phones, computers, tyres and motorcycles, will not attract the Eco Levy,” he stated.

Other amendments include:

- 16% VAT on bread removed

- Excise duty on vegetable oil removed

- VAT on transportation of sugar removed

- 2.5 per cent Motor Vehicle Tax removed

- Eco Levy on locally manufactured products removed

- eTims receded from farmers and small businesses with a turnover of below Ksh.1 million

- Excise duty imposed on imported table eggs, onions and potatoes to protect local farmers

- No increase in mobile money transfer

- VAT on financial services and foreign exchange transactions has also been removed

- The threshold for VAT registration has been increased from Ksh5 million to Ksh8 million. This therefore means that many small businesses will no longer need to register for VAT

According to the MP, pension contributions exemption will increase from Ksh20,000 per month to Ksh30,000.

Kuria noted that President William Ruto informed the Kenya Kwanza PG that the Executive and Legislature will continue making the right decisions no matter how difficult they are.

“The President also commended national institutions for working effectively in a democratic Kenya. The National Assembly has changed the Finance Bill that was prepared by the Executive. This is as it should be,” Kuria concluded.

Parliament will receive a report later today that includes the amendments.